THE HEADLINES SAY IT ALL, AMERICANS ARE BURIED IN DEBT.

WORSE THAN GREECE? YES, WE ARE.

ABOVE: UPDATED FROM 2 DAYS AGO, 05/05/2017, EACH AMERICAN FAMILY'S SHARE OF THE NATIONAL DEBT HAS NOW REACHED OVER $120,000, TO HELP US WRAP OUR MINDS AROUND THIS FACT, HERE ARE QUOTES FROM SOME OF OUR PRESIDENTS, SENATORS, REPRESENTATIVES, THE COURTS, THE BANKERS THEMSELVES, QUOTES MOST AMERICANS HAVE NEVER READ PERTAINING TO WHAT CREATED THIS UNPAYABLE, UNENDING DEBT . PLEASE READ CAREFULLY.

OUR LEADERS, POLITICIANS, FINANCIAL WIZARDS ALL KNEW THIS WAS GOING TO HAPPEN OVER 100 YEARS AGO, AND YET LED US DOWN THE PATH TO UNPAYABLE DEBT.

THEY FORCED US TO ACCEPT A SYSTEM THAT MAKES US ABSOLUTE SLAVES TO DEBT.

AND WE ALLOWED IT.

“The [private] Central Bank is an institution of the most deadly hostility existing against the principles and form of our constitution . . . . If the American people allow private banks to control the issuance of their currency . . ., the banks and corporations that will grow up around them will deprive the people of all their property until their children will wake up homeless on the continent their fathers conquered.”

“We are completely saddled and bridled, and…the bank is so firmly mounted on us that we must go where [it] will guide.”

(Thomas Jefferson, 3rd U.S. President, 'WRITINGS OF JEFFERSON').

In 1811 a bill was given to Congress to renew the Bank of the U.S.

A Congressman named P.B. Porter attacked the bank from the floor saying, “If the bank’s charter was renewed Congress would have planted in the bosom of this Constitution a viper, which one day or another would sting the liberty of this country to the heart.”

President James Madison, like Jefferson was a staunch opponent of the central bank. He wrote:

“History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance.”

President Andrew Jackson, warning the American people after he abolished the privately controlled central bank, the Bank of the United States. 1834, stated:

“The bold effort the present bank has made to control the government, the distress it has wantonly produced...are but premonitions of the fate that awaits the American people should they be deluded into a perpetuation of this institution or the establishment of another like it.”

“You are a den of vipers! I intend to rout you out, and by the Eternal God, I will rout you out. If the people only understood the rank injustice of our money and banking system, there would be a revolution by morning.”

President Abraham Lincoln, on creating his Civil War currency called the Greenback: "The Government should create, issue, and circulate all the currency and credit needed to satisfy the spending power of the Government and the buying power of consumers.

The privilege of creating and issuing money is not only the supreme prerogative of Government, but it is the Government's greatest creative opportunity.

By the adoption of these principles ... the taxpayers will be saved immense sums of interest. Money will cease to be master and become the servant of humanity."

Almost 50 years later, Congressman Charles A. Lindbergh, referring to the act which established

the Federal Reserve, according to the Congressional Record, Vol. 51, p. 1446. December 22, 1913, warned:“This Act establishes the most gigantic trust on earth.…When the President signs this Act, the invisible government by the Money Power, proven to exist by the Money Trust Investigation, will be legalized.…The money power overawes the legislative and executive forces of the Nation and of the States. I have seen these forces exerted during the different stages of this bill.…”

“The new law will create inflation whenever the trusts want inflation. It may not do so immediately, but the trusts want a period of inflation, because all the stocks they hold have gone down... Now, if the trusts can get another period of inflation, they figure they can unload the stocks on the people at high prices during the excitement and then bring on a panic and but them back at low prices.…The people may not know it immediately, but the day of reckoning is only a few years removed.” Senator Barry Goldwater was a frequent critic of the Federal Reserve, “Most Americans have no real understanding of the operation of the international moneylenders. The accounts of the Federal Reserve System have never been audited. It operates outside the control of Congress and manipulates the credit of the United States.” (Written in his book "With No Apologies" (1979), p. 282.)

IN 'Federal Reserve Bank of Chicago, Modern Money Mechanics' (1975):

"Neither paper currency nor deposits have value as commodities. Intrinsically, a dollar bill is just a piece of paper, deposits merely book entries. Coins do have some intrinsic value as metal, but generally far less than their face value."

"The Federal Reserve Banks, while not part of the government, are the central banking system for the Nation.… Holdings of Federal debt by the Federal Reserve Banks do not have the same impact on private credit markets as other debt held by the public. Their holdings of Federal debt arise from their role as the country's central bank." --Office of Management and Budget, Budget of the United States Government: Historical Tables (FY 1992), p. 10. Recent budgets omit "…while not part of the government…."

By making money artificially scarce interest rates throughout the country can be arbitrarily raised and the bank tax on all business and cost of living increased for the profit of the banks owning these regional central banks, and without the slightest benefit to the people.

These 12 corporations together cover the whole country and monopolize and use for private gain every dollar of the public currency, and all public revenues of the United States."

--Alfred Owen Crozier, testimony to the Senate Committee on Banking and Currency (23 October 1913), criticizing regional bank control of discount rates.

The [Federal Reserve] bill as it stands seems to me to open the way to a vast inflation of the currency.… I do not like to think that any law can be passed that will make it possible to submerge the gold standard in a flood of irredeemable paper currency.

--Henry Cabot Lodge Sr., 1913.

"As soon as Mr. [Franklin] Roosevelt took office, the Federal Reserve began to buy government securities at the rate of ten million dollars a week for 10 weeks, and created one hundred million dollars in new currency, which alleviated the critical famine of money and credit, and the factories started hiring people again. The increase in the assets of the Federal Reserve banks from 143 million dollars in 1913 to 45 billion dollars in 1949 went directly to the PRIVATE stockholders of the banks." -- Eustace Mullins, The Federal Reserve Conspiracy (1954).

From Lewis v. United States 680 F. 2d 1239 9th Circuit (1982), involving a man who was hit by a Federal Reserve Bank vehicle and attempted to sue the federal government, the findings of the court""Examining the organization and function of the Federal Reserve Banks, and applying the relevant factors, we conclude that the Reserve Banks are not federal instrumentalities for purposes of the FTCA [Federal Tort Claims Act], but are independent, privately owned and locally controlled corporations."

American Bankers Association, 1891, as printed in the Congressional Record of April 29, 1913: "On September 1st, 1894, we will not renew our loans under any consideration. On September 1st we will demand our money.We will foreclose and become mortgagees in possession. We can take two-thirds of the farms west of the Mississippi, and thousands of them east of the Mississippi as well, at out own price... Then the farmers will become tenants as in England."

(From the documentary "The Money Masters: How International Bankers Gained Control of America", produced by the Royalty Production Company 1998.)

Representative Wright Patman (D-TX) in 1964;

"In the United States today we have in effect two governments. We have the duly constituted Government. Then we have an independent, uncontrolled and uncoordinated government in the Federal Reserve System, operating the money powers which are reserved to Congress by the Constitution."

Theodore Roosevelt, New York Times, March 27, 1922:

"These International bankers and Rockefeller-Standard Oil interests control the majority of newspapers and the columns of these papers to club into submission or rive out of public office officials who refuse to do the bidding of the powerful corrupt cliques which compose the invisible government."

John Hylan, Mayor of New York - New York Times, March 26, 1922:

"The real menace of our republic is this invisible government which like a giant octopus sprawls its slimy length over city, state, and nation ... It seizes in is long and powerful tentacles our executive officers, our legislative bodies, our schools, our courts, our newspapers, and every agency created for the pubic protection...

... at the head of this octopus are the Rockefeller-Standard Oil interest and a small group of powerful banking houses generally referred to as the international bankers. The little coterie of powerful international bankers virtually run the United States government for their own selfish purposes.

They practically control both parties ... and resort to every device to place in nomination for high public office only such candidates as will be amenable to the dictates of corrupt big business...

These international bankers and Rockefeller-Standard Oil interests control the majority of newspapers and magazines n this country." But men in high places who are intent on American servitude to this monster and the global banking cabal have stated quite frankly that the central bank must be maintained at any cost.

Men like Zbigniew Kazimierz Brzezinski, who, in his book "Between Two Ages: America's Role in the Technetronic Era", p. 72-300, wrote in 1970:“Marxism represents a further vital and creative stage in the maturing of man's universal vision…The nation-state is gradually yielding its sovereignty…More intensive efforts to shape a new world monetary structure will have to be undertaken.” David Rockefeller wrote in his 2002 memoirs:

“Some even believe we are part of a secret cabal working against the best interests of the United States, characterizing my family and me as ‘internationalists’ and of conspiring with others around the world to build a more integrated global political and economic structure — one world, if you will. If that’s the charge, I stand guilty, and I am proud of it.”

David Rockefeller,1994 at a U.N. dinner:

"We are on the verge of a global transformation. All we need is the right major crisis and the nation will accept the New World Order."

AND THE ULTIMATE GOAL?

"These sectors of the doctrinal system serve to divert the unwashed masses and

reinforce basic social values: passivity, submissiveness to authority, the

overriding virtue of greed and personal gain, lack of concern for others, fear

of real or imagined enemies, etc. The goal is to keep the bewildered herd

bewildered." -Dr. Noam Chomsky, from What Uncle Sam Really Wants , censored ex

parte from WUTK radio's Alternative Nation, Summer 2001.

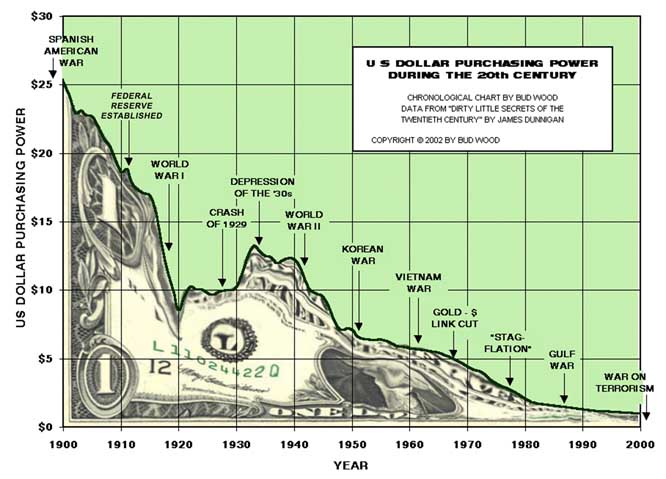

AS YOU CAN SEE ABOVE, IN ONLY 100 YEARS, MONEY HAS BECOME JUST ANOTHER PIECE OF PAPER.FROM THE YEAR THAT THE FEDERAL RESERVE WAS CREATED UNTIL THE START OF WORLD WAR 1, LESS THAN 5 YEARS, THE VALUE OF A DOLLAR BECAME WORTH HALF OF WHAT IT WAS WORTH BEFORE 'THE FED'.

"The people believe, against all evidence, that their elected political government rules their nation, and their "representative" government serves their interests.

This belief is observably false, and blatantly, obviously false in the U.S."

"Since I entered politics, I have chiefly had men's views confided to me privately. Some of the biggest men in the United States, in the field of commerce and manufacture, are afraid of somebody, are afraid of something. They know that there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they had better not speak above their breath when they speak in condemnation of it." “..we have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world—no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men." -- Woodrow Wilson, from his BOOK, The New Freedom: A Call for the Emancipation of the Generous Energies of a People (New York and Garden City: Doubleday, Page & Company, 1913).

In 1912, when Senator Robert M. LaFollette (Republican, Wisconsin) in arguments against establishing the FED, publicly charged that a money trust of fifty men controlled the United States, George F. Baker, partner of J.P. Morgan, on being queried by reporters as to the truth of the charge, replied that it was absolutely in error. He said that he knew from personal knowledge that not more than eight men ran this country.

EIGHT men, just 8.

That list in 2012 probably included the names Rockefeller, Rothschild (from his stronghold in Europe), Carnegie, Vanderbilt, Astor, Gould, Mellon and, maybe most especially, J.P. Morgan who died in 1913.

Today, 2017, just 8 men control over half the entire wealth of the world.

The world’s 8 richest people, 2017, are, in order of net worth:

Bill Gates: America founder of Microsoft (net worth $75 billion)

Amancio Ortega: Spanish founder of Inditex which owns the Zara fashion chain (net worth $67 billion)

Warren Buffett: American CEO and largest shareholder in Berkshire Hathaway (net worth $60.8 billion)

Carlos Slim Helu: Mexican owner of Grupo Carso (net worth: $50 billion)

Jeff Bezos: American founder, chairman and chief executive of Amazon (net worth: $45.2 billion)

Mark Zuckerberg: American chairman, chief executive officer, and co-founder of Facebook (net worth $44.6 billion)

Larry Ellison: American co-founder and CEO of Oracle (net worth $43.6 billion)

Michael Bloomberg: American founder, owner and CEO of Bloomberg LP (net worth: $40 billion)

HERE IT IS, THE ORIGINAL 'FEDERAL RESERVE ACT', ACTUALLY KNOWN AS

"Public Law 63-43, 63d Congress, H.R. 7837".

READ IT AND WEEP, AMERICANS.

32 PAGES OF 'LEGALESE' AND PHRASES THAT CAN BE "INTERPRETED" A DOZEN DIFFERENT WAYS.

BY PAGE 3, YOU SHOULD BE PROPERLY INCENSED.

ON PAGE 5: "EVERY Federal reserve bank shall be conducted under the supervision and control of a board of directors."

THAT WOULD BE THEIR BOARD OF DIRECTORS, THEIRS, A BOARD THAT DOES NOT ANSWER TO CONGRESS, NOR TO US.

THE PRIVATE BANK/BANKERS' BOARD ANSWERS ONLY TO THE FED, WHICH IS A CONGLOMERATE OF THE INTERNATIONAL BANKING CARTEL, WHICH FACT WE WILL EXPLORE AND SEE PROVEN.

ALSO ON PAGE 5: "No Senator or Representative in Congress shall be a member of the

Federal Reserve Board or an officer or a director of a Federal reserve bank."

WHY NOT?

BECAUSE THEY DON'T WANT CONGRESS KNOWING ANYTHING.

THE FEDERAL GOVERNMENT IS OUT OF THE LOOP.

THE FED RUNS THE FED.

ANOTHER BIG BONUS FOR THE BANKERS... The FED pays no taxes on the trillions of dollars it makes.

Peter J. Tanous, president of Lepercq Lynx Investment Advisory in Washington D.C., wrote in an article on CNBC, 25 Sept. 2013,

"The Fed's Hidden Agenda behind money-printing...If Americans find out that the lion's share of their income tax payments are going to service the debt (BECAUSE OF THE FED'S SET, LOW INTEREST RATE), prepare for a new American revolution. "

A FAIRLY DECENT ARTICLE ON THIS APPEARED, IN OF ALL PLACES, THE HUFFINGTON POST:, 2009:

"The American government — which we once called our government — has been taken over by Wall Street, the mega-corporations and the super-rich. They are the ones who decide our fate. It is this group of powerful elites, the people President Franklin D. Roosevelt called “economic royalists,” who choose our elected officials — indeed, our very form of government. Both Democrats and Republicans dance to the tune of their corporate masters. In America, corporations do not control the government. In America, corporations are the government."

HOW WE ALL BECAME DEBT SLAVES TO THE FEDERAL BANKING SYSTEM.

"In the good old days, after George Washington and the boys won the war to free us from the bank of England's predatory and impoverishing practices, they set up a "revolutionary" economic system.

The government created and issued all the public currency, spending it into circulation to purchase what the government needed, then after the currency circulated through society to fuel commerce, was taxed back to the government to balance the books.

This system not only reserved the choice whether to use the bank to the people, but it was a stable system, because as debt increased, the people could voluntarily choose to stop borrowing from the bank. That was one of the most important freedoms won during the revolution; the freedom to say "no" to the banks.

Then, in 1913, a corrupt Congress and a corrupt President changed the structure of the nation's economy and stole your freedom to say "no".

[MY NOTE: THE AMERICAN PEOPLE DID NOT GET TO VOTE ON THIS...CONGRESS DID, BUT NOT ALL OF CONGRESS. 28 SENATORS WERE NOT THERE TO CAST A VOTE. THE SENATE "AMENDED" THE ACT TO CREATE THE "BOARD OF GOVERNORS", 12 MEN, TO BE APPOINTED BY THE PRESIDENT, SUPPOSEDLY.]

The economic system reverted to a mirror of that same system the nation fought a revolution to be free of.

The power to issue money was taken away from the government and given to PRIVATE bankers and from that day onward,

ALL money in circulation was created as the result of a loan at interest from the bankers to the government, to business, and to the people.

There is no exception.

Every dollar paid in salary, spent to purchase food or gas, or paid in taxes, began as an interest bearing loan.

There is no money in circulation in the United States that did not start out as a loan at interest from the bankers at the privately-owned Federal Reserve system.

From that moment on, the freedom of the people to refuse to borrow from the banks and to refuse to pay interest was stripped away.

To participate in the commerce of the United States at all means being FORCED to use money loaned at interest, to the profit of the bankers and the impoverishment of the public. Your freedom to say "no" was stolen by Congress in 1913, without your permission and before you were born

When you have lost the freedom to say "no", when you have no choice but to pay a percentage of your earnings as interest to the bankers, whether in private debt or taxes to cover the gargantuan debts by the US Government itself, you are a slave to the bankers.

And because more money is owed to the bankers than actually exists, because of the interest charged on the loan that created the money, the debt-slavery is permanent! No matter how hard you work, no matter how much you sacrifice, the debt can never be paid off.

There is no freedom without the freedom to say "no."

Slaves cannot say "no" when ordered to surrender the products of their labor to their masters.

You are a slave.

Slavery exists only because the slaves have been taught to believe that slavery is the way the world is supposed to be. Beliefs are chains used to enslave free people. No chains of steel ever bound a human tighter than the chains made of the beliefs with which we are indoctrinated while young in the state schools and the churches.

Today the modern slaves (that is YOU) are held prisoner by their belief in compound interest; that they owe money that never existed to repay money created out of thin air. And you modern slaves will regain your freedoms when you realize that private central banking is just another illusion created by the enslavers to trick you into obedient servitude.

Stop believing. Cry freedom!"

FIRST, LET US ESTABLISH THAT THE FED IS A PRIVATE CORPORATION, NOT SUBJECT TO FEDERAL FREEDOM OF INFORMATION RULES.

IF THE ABOVE QUOTES DIDN'T CONVINCE YOU OF THIS, TRY THESE FACTS...

The U.S. Supreme Court ruled in 1928:

"Instrumentalities like the national banks or the federal reserve banks, in which there are PRIVATE interests, are not departments of the government. They are PRIVATE CORPORATIONS in which the government has an interest."

The applicable definition, "PRIVATE CORPORATION" is found in 28 U.S.C. § 451.

Look it up for yourselves.

In 1923, Representative Charles A. Lindbergh, a Republican from Minnesota, and father of the famous aviator, stated, “The financial system has been turned over to the Federal Reserve Board. That board administers the finance system by authority of a purely profiteering group. The system is private, conducted for the sole purpose of obtaining the greatest possible profits from the use of other people’s money.”

The long-time Chairman of the House Banking and Currency Committee, Louis McFadden, said on June 10, 1932 that the Fed was a PRIVATE MONOPOLY.

At that time, paper dollars were freely redeemable in gold; but banks were required to keep sufficient gold to cover only 40 percent of their deposits.

When panicked bank customers rushed to cash in their dollars, gold reserves shrank.

Loans then had to be recalled to maintain the 40 percent requirement, collapsing the money supply.

The result was widespread unemployment and loss of homes and savings, similar to that seen today.

In a scathing indictment before Congress in 1932, Representative McFadden blamed the Federal Reserve. He said:

"Mr. Chairman, we have in this Country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks . . . .

The depredations and iniquities of the Fed has cost enough money to pay the National debt several times over. . . .

Some people think that the Federal Reserve Banks are United States Government institutions.

They are private monopolies which prey upon the people of these United States for the benefit of themselves and their foreign customers; foreign and domestic speculators and swindlers; and rich and predatory money lenders.

These twelve private credit monopolies were deceitfully and disloyally foisted upon this Country by the bankers who came here from Europe and repaid us our hospitality by undermining our American institutions."

The Fed itself admitted it's a PRIVATE institution, NOT subject to FOIA (via Bloomberg):

"While the Fed’s Washington-based Board of Governors is a federal agency subject to the Freedom of Information Act and other government rules, the New York Fed and other regional banks maintain they are separate institutions, owned by their member banks, and not subject to federal restrictions.

For that reason, the New York Fed alleged in the lawsuit brought by Bloomberg to force the Fed to reveal some information about its loans – Bloomberg LP v. Board of Governors of the Federal Reserve System, 08-CV-9595, U.S. District Court, Southern District of New York (Manhattan) – that it was not subject to Federal Freedom of Information Act."

As Bloomberg reported in a separate article:

"The Federal Reserve Bank of New York … runs most of the lending programs. Most documents relevant to [a freedom of information lawsuit filed by Bloomberg news] are at the New York Fed, which isn’t subject to FOIA law [a law which applies to Federal agencies], according to the central bank. The Board of Governors has 231 pages of documents, to which it is denying access under an exemption for trade secrets.

San Francisco Federal Reserve research analyst David Lang confirmed this in 2011:

[Question]: “I had a really quick question, the Federal Reserve Bank of San Francisco specifically, is that formed as a private corporation itself?”

David Lang: “Ah yes it is actually. YES, our state chartered banks, banks under a charter, share that and we pay a dividend on those shares.”

The Fed is privately owned.

"Its shareholders are private banks. In fact, 100% of its shareholders are private banks. None of its stock is owned by the government."As the late German Economist Rudolf Hilferding argued long ago, the system of centralizing people’s savings and placing them at the disposal of profit-driven private banks is a perverse kind of socialism, that is, socialism in favor of the few:

“In this sense a fully developed credit system is the antithesis of capitalism, and represents organization and control as opposed to anarchy. It has its source in socialism, but has been adapted to capitalist society; it is a fraudulent kind of socialism, modified to suit the needs of capitalism. It socializes other people’s money for use by the few.”

The Federal Reserve Bank is not a publicly traded corporation and is therefore not required by the Securities and Exchange Commission to publish a list of its major shareholders.

THIS ALONE VEILS IT IN SECRECY.

WE CAN SEE WHOM THE PENTAGON DOES BUSINESS WITH, WHOM THE ENTIRE FEDERAL GOVERNMENT CONTRACTS WITH, BUT WE ARE NOT ALLOWED TO SEE THAT FROM THE FEDERAL RESERVE. IT IS FORBIDDEN.

WHEN ONE WALKS INTO ANY OF THE FED'S 12 "CENTRAL" BANKS, THE SIGN ON THE BUILDING NEVER READS "UNITED STATES BANK OF ___".

IT IS SUPPOSED TO BE A NON-PROFIT ORGANIZATION.

IT MAKES PLENTY OF PROFIT, HOWEVER.

Wright Patman, Chairman of the House Banking and Currency Committee in the 1960s, called the Federal Reserve “a total money-making machine.” He wrote:

“When the Federal Reserve writes a check for a government bond it does exactly what any bank does, it creates money, it created money purely and simply by writing a check.”

If the Fed were actually a federal agency, the government could issue U.S. legal tender directly, avoiding an unnecessary interest-bearing debt to private middlemen who create the money out of thin air themselves. "

The Fed generates profits for its BANKER shareholders.

"The interest on bonds acquired with its newly-issued Federal Reserve Notes pays the Fed’s operating expenses plus a guaranteed 6% return to its banker shareholders. A mere 6% a year may not be considered a profit in the world of Wall Street high finance, but most businesses that manage to cover all their expenses and give their shareholders a guaranteed 6% return are considered “for profit” corporations.

In addition to this guaranteed 6%, the banks will now be getting interest from the taxpayers on their “reserves.”

Consider this: every year, the FED profits by hundreds of billions of dollars by buying U.S. Government Bonds, "Treasuries". Yet it only returns approximately $20 billion to the US Treasury. The rest of the profit has been spent as "Operational Expense" we're told.

The FED expects us to believe that the FED operational expenses amounts to hundreds of billions of dollars every single year.

It's just not possible that's true.

From the FED's own website:

"Each of the 12 Reserve Banks operates within its own particular geographic area, or District, of the United States, and each is separately incorporated and has its own board of directors. Commercial banks that are members of the Federal Reserve System hold stock in their District's Reserve Bank.

BLOOMBERG AND FOX 'NEWS' , IN LATE 2008, BOTH FILED FREEDOM OF INFORMATION REQUESTS FOR A LIST OF BANKS THE FED 'LOANED' BILLIONS TO DURING THE ECONOMIC COLLAPSE OF 2007-2008.

THEY THEN FILED LAWSUITS AGAINST THE FED TO FORCE THE RELEASE OF INFORMATION.

During the financial crisis, the U.S. Congress, Federal Reserve, Treasury Department and Federal Deposit Insurance Corporation, developed the Emergency Economic Stabilization Act of 2008 to shore up financial institutions by purchasing mortgage-backed securities, and loaning cash directly to banks and bank holding companies.

Unfortunately, many of the distressed banks would not come forward to accept such loans publicly for fear of a bank run and loss of investors.

As a result, the Federal Reserve developed a program for those banks and financial institutions to access the discount window which is not normally subject to publication.

WHERE THERE IS A WILL, THERE IS A WAY AND THE FED CREATED SUCH A WAY, HIDDEN FROM PUBLIC SIGHT.

[NOTE: BTW, the Fed is composed of twelve branches, all of which are 100 percent owned by the PRIVATE banks in their districts. Until 1935, these branches could each independently issue paper dollars JUST for the cost of printing them, and could lend them at interest.]

FOR TWO YEARS THE COURT BATTLE DRAGGED ON, APPEALS BY THE BANKS, THE FED, BUT IN 2010, A THREE-JUDGE PANEL TOLD THE BANKS/THE FED THEY HAD TO RELEASE THE DOCUMENTS... ANOTHER APPEAL ENSUED, THE FED PULLED OUT OF THE APPEAL, CLEVER FOXES, BUT FINALLY, IN 2011, THE APPEAL WAS REJECTED AND BLOOMBERG GOT WHAT IT HAD LONG SOUGHT - OVER 29,000 PAGES OF DOCUMENTS.

MORE THAN TWENTY-NINE THOUSAND PAGES... NOT EVEN THE TIP OF THAT ICEBERG.

The news organizations requested loan documents called “term sheets” from the Federal Reserve for banks that took part in the more than $3 trillion loan program.

[MY NOTE: YES, THAT'S 3 TRILLION IN LOANS!: $10,699,804,864,612.13 was the total national debt at the end of the year 2008.

So the FED 'loaned' about one-third of the amount of our national debt to shore up and/or bail out their 'babies'.]

The term sheets include the banks’ names, the amounts borrowed and the collateral posted in return.

The primary argument the banks made against release was the threat of economic harm to the banks and the impact additional consumer panic could bring to the economy if it was revealed that major financial institutions were in danger of failing and needed government loans.

The U.S. Court of Appeals in New York City (2nd Cir.) held in both cases — Bloomberg L.P. v. Board of Governors of the Federal Reserve System and Fox News Network, LLC v. Board of Governors of the Federal Reserve System — that the records could not be withheld under Exemption 4 to FOIA, which exempts confidential, commercial or financial information that is obtained by the government from an outside person or organization.

The court found that, because the records requested were records generated by the Federal Reserve itself about its lending program and not information received from an outside source, withholding the documents was improper.

Clearing House Association LLC, a coalition of banks that received the discount loans, appealed to the U.S. Supreme Court. The Federal Reserve declined to join the appeal after fighting the document release at the trial and appeals court levels.

Ten days after the Court’s decision, the records requested by Bloomberg and Fox News — totaling more than 29,000 pages — were released.

The documents revealed that FOREIGN banks, including the Central Bank of Libya, received large portions of the loans given out during the bailout’s peak.

And the harm that was threatened to the banks if the records were produced?

Bank stocks INCREASED in the period following the information’s release, more than two years after the funds were received, undercutting the banks’ argument that the documents should never be released.

The release of the records — a victory for open government advocates — is short-lived.

The Dodd-Frank Wall Street Financial Reform Bill, passed in July 2010, created a two-year grace period for releasing data on discount window loans given after July 21, 2010, a date beyond any of the records requested by Bloomberg or Fox. While the argument that the documents should never be released is negated, requesters must wait two years before getting information on future loans.

[THANK A REPUBLICAN FOR THAT ONE.THEY HAD THE MAJORITY IN CONGRESS.]

THE APPROACHING NEW "BUBBLE"? ANOTHER BAILOUT?

The New Yorker magazine asked on January 20, 2016, "Are We Already in a Bear Market?"

"With the stock market falling again on Wednesday—the Dow Jones Industrial Average closed down about two hundred and fifty points—we’ll be seeing a lot of talk about whether we have entered a bear market. Such discussions rarely yield much insight.

On Wall Street, the conventional definition of a bear market is a fall in stock prices of more than twenty per cent from the previous peak: anything less is referred to as a “correction.”

But this definition can be misleading.

Caterpillar is down almost fifty per cent; IBM is down forty-three per cent; Chevron is down forty-one per cent. Even the mighty Apple is down twenty-seven per cent. Doesn’t that sound bearlike?

How, you may ask, can the average Dow stock be more than twenty per cent below its peak when the over-all average is down just fourteen per cent?

So, what does all this mean?

To get a real read on where the market might be headed, we’ll need to see if the oil price stabilizes, what happens in China, and how the Federal Reserve reacts to the recent sell-offs. Until then, we can expect more turbulence."

AHHH, THE LANGUAGE OF FINANCE, PURPOSELY CREATED TO KEEP MOST AMERICANS IN THE DARK...IT'S JUST "OVER OUR HEAD" TO UNDERSTAND SO WE TRUST OTHERS TO INTERPRET FOR US AND WE GET LED DOWN THE GARDEN PATH TO...RUIN.

DURING THE CRASH OF 2005-2008, A COUPLE OF FRIENDS OF MINE LOST OVER $200,000 IN ONE DAY...ONE DAY!

WHEN THE HUSBAND CONFRONTED THEIR 'BROKER', HE JUST SHRUGGED AND SAID, "WE NEVER KNOW WHAT THE MARKET IS GOING TO DO. WE AREN'T SEERS, MY FRIEND. WE CAN'T SEE THE FUTURE. SORRY."

SORRY? YEAH, $200,000+ SORRY.

IT WAS A FATE SHARED BY MANY AMERICANS WHO TRUSTED THE MARKET, THE FED, UNCLE SAM.

IT'S BECAUSE MOST OF US DON'T GO READ THINGS LIKE THE FOLLOWING THAT WE BLINDLY FOLLOW THE "FINANCIAL EXPERTS".

THE QUESTIONS RAISED BY THIS GUY NEED TO BE ASKED BY EVERY AMERICAN CITIZEN.

"I see no specific place to request an article, but I do have such a request for whatever "expert economists" write for this site.

How about a nice lengthy article on how and why the U.S. government allowed the Federal Reserve to create a system in which an eternally unpayable aggregate debt is forced upon an entire nation, why no matter how many citizens work and pay taxes and spend 'real' money on goods and services and deposit those pathetic paychecks into banks as 'savings', we, as a nation, and often as individuals, just never, ever climb out of debt?

Could we perhaps get some clarification as to why government-created money was deemed unsafe or unwise, while the FED's PLAY money, that money that is eternally "on the books" but never in great piles before us, was considered AT ALL?

When a bank issues a mortgage, doesn't that bank simply CREATE the money?

When the FED loans another nation $9 trillion U.S. dollars, where does that come from?

When Senators ask the FED anything, the FED usually just laughs in their faces.

Tell us how the FED can ignore Congress?

America is in the red, in debt, the "national debt" increasing every day, and the FED manages and manufactures our 'money'?.

Could the fact that the USA actually has NO real money supply, just what the FED calls money, perhaps be addressed?

How did an entire nation of working people get to be debt slaves stuck with Monopoly money instead of the real thing?

And, please, perhaps your experts can convince Americans that the FED is NOT federal, not an agency but an admitted 'independent corporation' as their attorneys stated in FOX News & Bloomberg v. Board of Governors ?"

DID HE GET ANSWERS TO THOSE QUESTIONS?

NOPE.

HOW CAN ANYONE LOGICALLY EXPLAIN THIS:

The U.S. has fallen MUCH deeper into the red in the aftermath of the global financial crisis, but the balance sheets of corporations have improved significantly.

U.S. companies, in fact, are sitting on a record $2 trillion in cash.

THAT 2008 BAIL-OUT WAS GREAT FOR WALL STREET AND BANKS THAT THEY DEPEND ON TO BUILD THEIR WEALTH...THEIR WEALTH, NOT OURS.

US debt is unpayable under the Federal Reserve System because the US does not have a money supply; it has a “debt supply.”

If we paid the debt, what we use for money would disappear entirely.

The 1% in government gave the 1% in banking legal authority to create debt and lend it to the 99% of us at interest.

The 1% in government can also borrow at interest and then tax the 99% to pay the interest cost.

The Federal Reserve System causes Americans to be perpetual debt-slaves.

It's basically the 1% parasitizing the 99%’s work.

Americans, for the most part, almost 60% today, do not earn enough to live on, so we borrow, in one way or another, then try to pay back WITH INTEREST and cannot ever 'get ahead'.

The Federal Reserve System causes/creates inflation: Banks "EXPAND" what we use for money, credit, when they make loans. Banks profit from making loans.

Increased credit, our “debt supply” , the opposite of debt-free REAL MONEY supply, works to increase inflation.

So in our current Federal Reserve System, the very profit-generating mechanism of the banks is in conflict with a stated goal of the Fed.

The 1% thereby causes inflation to charge [US] the 99%, interest on the increasing “debt supply.”

The 99% pay for this TWICE: first in the decreased value of their savings and secondly, by paying interest.

Banks maximize their profits by maximizing interest rates. Minimizing interest rates would occur only at non-profit rates as a public service.

Bank profits are over $100 billion a year; a cost to the average US family of $1,000/year (there being roughly 100 million US households).

GOOD OLD TIME MAGAZINE TRIED TO DOWNPLAY A 'REVELATION' OFFERED BY JAMES GRANT THAT SHOWED, AT THE LEAST, EVERY MAN, EVERY WOMAN, EVERY CHILD IN AMERICA "OWES' OVER $42,000 OF DEBT TO PAY OFF THE U.S. DEBT.

FOR THOSE WHO THINK INDEPENDENTLY, THEY FAILED TO CONVINCE THAT "ALL IS NOT THAT BAD".

IT'S WORSE, 'TIME', MUCH WORSE.

James Grant argued last week that every man, woman, and child effectively owes $42,998.12 thanks to Washington's free-spending ways.

"To understand our financial fix, put yourself in the position of the government. Say you earn the typical American family income, and you spend and borrow as the government does. So assuming, you would earn $54,000 a year, spend $64,000 a year and charge $10,000 to your already slightly overburdened credit card. I say slightly overburdened–your outstanding balance is about $223,000."

The federal government has a central bank to manipulate the economy, the currency, and interest rates to make life easier for Washington policymakers.

CITIZENS don't have that.

Workers, for instance, may have trouble obtaining credit if they're out of work, their homes are losing value, and the economy is lousy.

AMERICANS OUT OF WORK OR SERIOUSLY "UNDER-EMPLOYED" WILL ALSO LOSE IT ALL WHEN THEY CAN'T PAY WHAT THEY ALREADY OWE

NOT THE FEDERAL GOVERNMENT!

The federal government, by contrast, can issue new debt and "refinance" old bonds at better terms when the economy is slowing and interest rates are falling.

Also, the U.S. government does not have a finite lifespan, while the average American lives less than 79 years. When individuals die with debt, those obligations must be taken care of by their estates, which cuts into what's left for their heirs. So someone is always on the hook for repayment. The Federal government does not have a literal ticking clock to race against.

WE DO.

ONLY WORKERS LOSE WHAT THEY CAN'T PAY FOR.

The average U.S. household has outstanding MORTGAGE debt of more than $168,000. Average household incomes, meanwhile, are just below $55,000. That means the typical household's debt-to-"personal GDP" ratio would be more than 300%.

ADD a car payment, kids in school/college, insurances, property taxes, utilities, basic family needs...well, you can see why we're overwhelmed with "typical" debt.

Now compare American citizens to the federal government...

Typically, families seeking a mortgage would have to show banks that their debt payment obligations (housing costs, car loan payments, student loan bills, credit card payments, etc.) represent less than 36% of their gross income.

LESS than 36%? That's IMPOSSIBLE for most workers!

But Washington's numbers?

THEY'RE MAGIC!

Last year, Washington's total interest payments to "SERVICE" the national debt was just under $225 billion.

At the same time, the federal government pulled in nearly $3.2 trillion in total REVENUES last year. So the federal government's debt obligations represented just 7% of its income, down from 17% in 1995.

While Americans don't have a REAL way to "rob Peter to pay Paul", the Feds DO.

MOST of the time, they rob Social Security for just about everything.

In a very sneaky fashion, the government has the "Social Security Trust" buy Treasury securities with short-term Social Security surpluses.

YES, SOCIAL SECURITY STILL HAS A SURPLUS, BRINGING IN MORE THAN IT PAYS OUT, SO "UNCLE SAM" STEALS THAT, LEGALLY.

THINK ABOUT THAT...WHEN WOULD THE GOVERNMENT-CONTROLLED "SOCIAL SECURITY TRUST" EVER DEMAND PAYBACK FORM THE GOVERNMENT-OWNED TREASURY?

NEVER, OF COURSE...NEVER.

IT'S NOT A LOAN, NOT AN INVESTMENT...IT'S PURE, UNCUT EMBEZZLEMENT, MADE LEGAL BY THAT WIZARDRY THAT KEEPS A BANKRUPTED AMERICA AFLOAT.

"The Federal Reserve also holds nearly $2.5 trillion in Treasury debt."

OUR CREATED ENTITY, WHAT WE HAVE SHOWN IS A PRIVATE CORPORATION, USES 'MONEY' IT CREATES OUT OF THIN AIR TO BUY TREASURY NOTES THAT THE FEDERAL GOVERNMENT THEN OWES THAT PRIVATE BUNCH OF BANKS, KNOWN COLLECTIVELY AS THE FEDERAL RESERVE SYSTEM!

AND NOW, WE, THE HUMBLE PEOPLE, THE 99%, WORKERS, COMMONERS, WE GET TO PAY THAT DEBT OFF FOR UNCLE SAM.

WE GET TO WORK ALL OUR LIVES TO TRY TO PAY WHAT WE'RE TOLD WE OWE.

BUT IT CAN'T BE DONE.

IT SIMPLY WON'T EVER BE DONE.

WAVE THE MAGIC WAND, PRESTO-CHANGE-O, LESS DEBT THAN THEY ACTUALLY HAVE!

BUT WE, THE PEOPLE, STILL OWE EVERY DIME OF THE ACTUAL, THE REAL DEBT, THAT TRILLIONS THAT THE FEDS "DISAPPEARED" WITH THEIR HAT-TRICK.

IT'S STILL THERE AND WE STILL OWE IT.

Since you can't count the government as a victim of money it is loaning to itself, the actual outstanding balance is,, IN A POOF OF FINANCIAL MANIPULATION, closer to $13.9 trillion, which works out to $42,998.12 per man, woman, and child.

AND THEN, OUR LYING CONGRESS STARTS SCREAMING ABOUT SOCIAL SECURITY GOING BROKE!

STOP STEALING FROM IT, FOOLS!

STOP ROBBING CITIZENS' ACCOUNTS TO PAY YOURSELVES!

STOP SPENDING MONEY EARMARKED FOR SOCIAL SECURITY, PAID IN BY AMERICA WORKERS, TO PAY FOR YOUR TRILLION-DOLLAR WARS IN SANDLOT NATIONS, AND STOP SENDING OTHER NATIONS "FINANCIAL AID"!

AMERICANS NEED SOME FINANCIAL AID!

AMERICANS NEED "BAIL-OUTS"!

Do you have a 401K, a "mutual fund" you pay into at work?

Then, yet again, you're paying the FEDERAL GOVERNMENT for NOTHING.

Mutual funds across the nation hold over a TRILLION dollars in worthless "U.S. TREASURIES".

They're worthless because we never get REAL money in return from them. We get MONOPOLY MONEY.

I showed once before how this actually works.

THERE IS NO LIMIT TO HOW MANY "TREASURIES", OF ONE KIND OR ANOTHER, ARE ISSUED.

Let's run through that fiasco one more time.

There are four types of marketable 'treasury securities':

Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS).

Each "matures" at different times, each have different "interest rates" (T-BILLS pay NO interest priot to maturity) and they all live in that "NeverLand" of "Let's pretend the FED has collateral".

There are also several types of non-marketable treasury "securities" that are not exactly SECURE but we PRETEND they are to play the FED's game. These include State and Local Government Series (SLGS), Government Account Series (GAS) debt issued to government-managed trust funds, and those old "savings bonds".

All of the marketable Treasury securities are very 'liquid' and are heavily traded on the secondary market. The non-marketable securities (such as savings bonds) are issued to subscribers and CANNOT be transferred through market sales.

HERE'S THE SLEIGHT-OF-HAND FEDERAL RESERVE TRICK:

Federal Reserve Banks are required to hold collateral equal in value to the Federal Reserve notes (MONOPOLY MONEY) that the Federal Reserve Bank puts into circulation. This collateral is chiefly held in the form of U.S. Treasury debt and government-sponsored enterprise securities.

IT IS ALL "ON PAPER" AND IF THE FED NEEDS MORE "COLLATERAL", IT SIMPLY PULLS IT OUT OF THIN AIR.

NEED CASH?

PRINT IT!

BUT THEY DON'T REALLY EVEN HAVE TO DO THAT.

IT'S ALL DONE IN "LEDGERS", "STATEMENTS".

ONE SMART VIDEO I SAW YEARS AGO, AND CAN'T FIND NOW, SHOWED THE BEGINNING OF THE DAY AT ONE DESK OF THE ILLUSTRIOUS TREASURY DEPARTMENT, THEN THE INCOMING DEBITS AND CREDITS STARTED COMING IN AND THINGS MOVED TO ANOTHER DESK, AND, AT THE END OF THE DAY, THE "TALLY SHEETS" WERE SIMPLY CARRIED ACROSS THE ROOM BY SOMEONE FROM A 3RD DESK AND PLACED IN A SMALL SAFE, KEPT THERE OVERNIGHT AND TAKEN OUT NEXT DAY BY THE SAME PERSON AT DESK 1 TO REPEAT THE PROCESS.

NO BIG TRUCKS HAULING GOLD, NO BIG TRUCKS MOVING MONEY, JUST ALL ON PAPER.

UNDERSTAND THIS, CITIZENS, THE FED HAS NEVER BEEN FULLY AND PAINSTAKINGLY AUDITED!

WE HAVE NO CLUE WHAT THEY DO OR HOW OR WITH OR TO WHOM!

IT'S A CARNIVAL SHELL GAME.

NOW THE FED WILL DISAGREE AND POINT TO "125 AUDITS" OR SO, AND WE CAN READ ABOUT THE GAO (GOVERNMENT ACCOUNTING OFFICE) "AUDITING THE FED", BUT HERE'S WHAT' "AUDITED"...HOW THE FED DOES BUSINESS...THE END.

The GAO "examines" how well the Fed is enforcing its OWN regulatory powers over its OWN PRIVATELY OWNED member banks. In 1992 it drew attention to the Fed's sluggish compliance with regulatory reforms mandated by the Foreign Bank Supervision Act of 1991. In examining the Fed's payment system activities, the GAO made the Fed aware of how its pricing policies for such services as check-clearing affected private suppliers of check-clearing services, and also suggested ways to speed up the process of check collections.

The GAO "examined" security markets, did an "analysis" of risks and benefits of interstate banking, regulation of derivatives, and the budget of the Federal Reserve system.

THE GAO NEVER ONCE SAW THE REAL MONEY (GOLD) THAT SUPPOSEDLY EXISTS TO BACK UP ALL THE FEDS "ISSUANCES", TRILLIONS IN LOANS, ETC.

SHOW US THE REAL MONEY!

THE FED SAYS, "KISS MY ENTIRE BUTT!"

THE FED PLACED SOME REAL DOOZY STOPS TO WHAT THE GAO CAN SEE.

WHAT'S NOT SEEN CANNOT BE AUDITED.

HERE'S THE SHORT LIST:

The Government Accounting Office does not have complete access to all aspects of the Federal Reserve System. The law excludes the following areas from GAO inspections (31 USCA §714):

(1) transactions for or with a FOREIGN central bank, government of a FOREIGN country, or non-private INTERNATIONAL financing organization;

(2) deliberations, decisions, or actions on monetary policy matters, including discount window operations, reserves of member banks, securities credit, interest on deposits, open market operations;

(3) transactions made under the direction of the Federal Open Market Committee;

(4) a part of a discussion or communication among or between members of the Board of Governors and officers and employees of the Federal Reserve System related to items.

IN SHORT, THE GAO CAN'T SEE JACK OR SQUAT!

DO YOU GET IT NOW?

NOW DO YOU SEE WHY MEN LIKE RON PAUL SAY THE FED WAS NEVER AUDITED?

THE FED THUMBS ITS NOSE AT REAL AUDITS, COMPLETE AUDITS, OR EVEN AT A LOOK AT HOW MUCH GOLD THEY HAVE IN STORAGE, AND SIMPLY THREATENS TO SHUT-DOWN THE U.S. ECONOMY IF CONGRESS PUSHES IT.

WE'VE ALL SURELY SEEN THOSE VIDEOS OF BERNANKE ESPECIALLY DOING JUST THAT, OPENLY, ON CAMERA BEFORE SENATE OR HOUSE HEARINGS. USUALLY, HE JUST LAUGHED AND LAUGHED.

WHEN GERMANY DEMANDED ITS GOLD BACK FROM THE FED, THEY STALLED AND REFUSED TO EVEN SHOW THEM ONE WEE STACK OF GOLD BARS FOR YEARS.

SAME HAPPENED WHEN OTHER NATIONS DEMANDED THEIR GOLD BACK.

TO TELL AN ENTIRE COUNTRY, "SCREW YOU, NO CAN DO!"...THAT'S POWER, MY FRIENDS.

AND THOSE "INDEPENDENT AUDITS"?

HA HA HA HA HA!

EACH Reserve Bank also has its OWN internal audit mechanisms. The Board contracts each year with an outside accounting firm to evaluate the audit program's EFFECTIVENESS.

Price Waterhouse conducted an audit of the Board's 1994, 1995, 1996, 1997, and 1998 financial statements and filed this report in the Board's 1996 Annual Report (nearly identical ones appear in other Annual Reports):

"We have audited the accompanying BALANCE SHEETS (YES, JUST BALANCE SHEETS PROVIDED BY THE FED) of the Board of Governors of the Federal Reserve System (the Board) as of December 31, 1995 and 1994, and the related statements of revenues and expenses for the years then ended. These financial statements are the responsibility of the Board's management. Our responsibility is to express an opinion on these FINANCIAL STATEMENTS based on our audits.

In our opinion the FINANCIAL STATEMENTS referred to above present fairly, in all material respects, the FINANCIAL POSITION of the Board as of December 31, 1995 and 1994, and the results of its operations and its cash flows for the years then ended in conformity with GENERALLY ACCEPTED ACCOUNTING PRINCIPLES.

We conducted our audits in accordance with generally accepted accounting standards and Government Accounting Standards issued by the Comptroller General of the United States. Those standards require that we plan and perform the audits to obtain REASONABLE ASSURANCE about whether the financial statements are free of material MISSTATEMENT."

TRANSLATION: "THE FED SAYS ALL IS WELL, SO ALL MUST BE WELL. WE NEVER SAW ANY MONEY BUT THE FED SAYS IT'S THERE. WOULD THEY LIE?"

WOULD THEY EVER!

AND THEY NEVER "SHOW THEM THE MONEY"....THAT ELUSIVE COLLATERAL TO BACK UP ALL TRANSACTIONS.

THE FED COULD HAND THEM A PAGE OUT OF A CHILD'S COLORING BOOK AND THE GAO AND OTHER "AUDITORS" WOULD JUST EAT IT AND SMILE.

CONGRESS PRETENDED TO PROTEST, WANTED ACCESS TO ALL THOSE THINGS, BUT MET WITH THE REASONS WHY THEY COULDN'T GET ACCESS...EVER.

In 1993 Wayne D. Angell, then a member of the Board of Governors, submitted testimony before a House subcommittee on the reasons for the restrictions on GAO access. He commented,

By excluding these areas, the Act attempts to balance the need for public accountability of the Federal Reserve through GAO audits against the need to insulate the central bank's monetary policy functions from short-term political pressures and to ensure that foreign central banks and governmental entities can transact business in the U.S. financial markets through the Federal Reserve on a confidential basis.

READ IT AGAIN: "to ensure that foreign central banks and governmental entities can transact business in the U.S. financial markets through the Federal Reserve on a confidential basis."

TRANSLATION: "WE'LL DO AS WE DAMNED WELL PLEASE AND TRADE WITH WHOM WE PLEASE. KISS OUR COLLECTIVE BUTTS!"

WHEN CONGRESSMEN LIKE RON PAUL OR ALAN GRAYSON PUSHED THE FED'S BACK AGAINST THE WALL AND PLAINLY ACCUSED THEM OF FAKERY, THE REST OF CONGRESS HOWLED LIKE BANSHEES TO SHUT THEM UP.

"DON'T PISS THE DRAGON OFF, IT'LL EAT US. BE AFRAID, BE VERY AFRAID!"

PROOF THAT OTHER NATIONS ARE AWARE THAT THE FED CAN'T PAY UP, THAT THE TREASURY IS EMPTY, THAT WE DON'T HAVE THAT MYTHICAL COLLATERAL, CAME WHEN BOTH CHINA (BTW, JAPAN HOLDS AS MUCH IN T-NOTES AS CHINA DOES) AND LITTLE SAUDI ARABIA THREATENED TO "BANKRUPT AMERICA" BY SELLING OFF THE TREASURY NOTES THEY HOLD.

THEY KNEW WE CAN'T PAY UP.

WE'RE BROKE, BEYOND BROKE, BUT NOT "ON PAPER".

ONLY "ON PAPER" DOES THE UNITED STATES EXIST AT ALL, FINANCIALLY.

IT'S ALL DONE "ON THE BOOKS" AND BOOKS ARE MADE TO BE "COOKED", YES?

IF ALL WE CITIZENS HAD TO SHOW WERE FIGURES WE PULLED OUT OF THIN AIR AND TYPED THEM ONTO A SHEET OF PAPER AND NEVER HAD TO "SHOW THE MONEY", WHAT FUN COULD WE HAVE, HMM?

THE FED, THE "TREASURY", OUR 'GOVERNMENT' HAVE ALL BEEN CAUGHT WITH THEIR PANTS AROUND THEIR KNEES BEFORE, AFTER ALL.

AN EXAMPLE OF THIS IS THOSE WORLD WAR ONE "LIBERTY BONDS".

After the war, the Liberty bonds were reaching maturity, but the Treasury was unable to pay each down fully with only limited budget surpluses. The resolution to this problem was to REFINANCE THE DEBT with variable short and medium-term "MATURITIES". Then the Treasury issued (REISSUED, REALLY) debt through fixed-price subscription, where both the coupon and the price of the debt were dictated BY THE TREASURY.

INSANITY RULED, BUT THEY PULLED IT OFF!

The system then got a case of "chronic over-subscription" because interest rates were so attractive that there were more purchasers of debt than supplied by the government. This meant that the government was paying too much for debt.

As government debt was undervalued, debt purchasers could buy from the government and immediately sell to another market participant at a higher price.

OOPS!

In 1929, the US Treasury shifted from its fixed-price subscription system to a system of auctioning where 'Treasury Bills' would be sold to the highest bidder. The "MARKET" now sets the price.

IT WAS A MARRIAGE MADE IN HELL.

WHY PEOPLE WON'T BELIEVE THE TRUTH ABOUT MONEY

"Our bank-issued money system and our capitalist economic production system together perform the dismal function of permanently saddling nations with unpayable debt.

But most people do not know or refuse to believe that commercial banks issue the world's money supply by creating BANK DEPOSITS to fund loans and to fund bank purchases of government debts (bonds).

Most people believe "the government" issues the money, and spends the money into existence in "the economy"; then people deposit the government money in banks, and banks lend out their depositors' savings...In fact we use CREDIT money that is issued by banks and loaned into existence, not fiat money that is issued by governments and spent into existence. So aside from members of the monetary reform and public banking communities, most people do not see the simple arithmetic of bank-issued money (and debt), and are mentally blind to the system's fatal arithmetic flaws.

Feudal kings acquired land by military conquest and held it by dividing the spoils with a class of nobles who shared the king's love of power, wealth and privilege ... and who were willing to perform mass murder (war) and oppression (serfdom) in order to enjoy what they desired.

Capitalists accumulate "property" (industrial, territorial, intellectual, commercial, etc.; and above all liquid property in the form of money) by financial conquest, supplemented and secured by the legislative, legal, police and military power of the capitalist state.

Capitalism, like feudalism before it, is rule by ownership. Feudal monarchies owned all the land. Capitalists own the national money-issuing systems and, as a consequence, build up and/or buy up ownership of the most monopolizable and money-profitable wealth-producing industrial infrastructure, as well as strategic infrastructure like inventions and scientific technology that can be turned to profitable and/or military uses.

War is typically thought of as a "cost" to nations, who spend their efforts building things then blowing them up, and whose enemies spend their efforts blowing your stuff up, so when all these self-destructive economic efforts are concluded you have to do a lot of rebuilding work just to get back to where you were before the war.

War is an economically negative sum activity. When the war is over, you have to add a lot of positive effort to get back to ZERO.

Money-issuing bankers and plutocrat investors (i.e. the capitalist over-class) are the historical market for government bond-debt, so the nations owe semi-annual interest payments to the capitalists, and always "owe" loan principal repayments whenever the bonds mature, even if governments continually roll over and never actually pay down their national debt. National debt hangs as a sword of Damocles over the political heads of nations.

That giant sucking sound is money flowing from taxpayers to bondholders.

Capitalists have figured out how to make war profitable to capitalists, and to simultaneously gain power over political governments. By their private ownership of the money-issuing system (the commercial banks), capitalists act as a monetary Leviathan, to keep them all in debt.

War is the best way to indebt nation-states. The people are indebted with small business debt and consumer debt, primarily mortgages, but also car loans, credit card debt and student debt.

Within the past year in the US, total student debt has surpassed total credit card debt, in the $1 trillion range. A trillion dollars is a lot of debt for borrowers, and a lot of money for the people who sold stuff to the borrowers and now own the money that was spent.

When a bank issues a mortgage, the bank creates the money that it uses to fund the loan. Bank-issued mortgages add new money into the money supply. Then the bank sells the mortgage into the capital markets system, which bundles mortgages and converts them into mortgage-backed securities that are marketed to large pools of previously saved money like pension funds.

Investors' savings are used to purchase borrowers' mortgage debts from the banks, so it is ultimately the investors' savings that provide loanable funds for mortgages and collateralized consumer debt. In this way the capital markets financial system functions in exactly the way most people (wrongly) believe the banking system functions: by lending savers' savings to borrowers.

Bankers are capitalists who want to accumulate more money, not ownership of more collateral assets.

If a borrower has, or can buy, a monopoly that guarantees high profits, then the borrower will be able to pay the banker's interest and repay the loan principal, and all's right with the banker's world.

So bankers favor lending to monopolists, which systematically enables the buyout of free market small businesses by monopolists.

Secondly, if you don't pay the interest and pay ALL the money back, the banker gets your house or farm or business or your cargo of trade goods. That is, unless you the borrower pays the banker more money than the banker loaned into existence, the banker takes ownership of your collateral. You have already made some payments, and the collateral is worth more than the balance owing, so the banker gets the benefit of the difference between the amount owed and the sellable price (liquidation value) of the collateral.

Either way, the bank-issued money system disfavors individual small business competitors, and encourages monopolists.

A banker can create a billion dollars of spendable money with a few keystrokes. It takes armies of workers and territories of resources to produce a billion dollars worth of real economic wealth. But the created money can buy (or foreclose upon) the produced wealth, transferring ownership of the real wealth from the people who produced it to the banker who financialized it.

The people believe, against all evidence, that their elected political government rules their nation, and their "representative" government serves their interests.

This belief is observably false, and blatantly obviously false in the US. To get elected and to remain in their political seats, politicians serve the capitalist rulers, not the democratic masses.

But the people, who are psychologically incapable of acknowledging the awful truth that they are ruled by owners, not served by their elected representatives, choose to believe democracy is real.

So they waste their political efforts within the impotent delusion of democracy, while their rulers do whatever they want without fear of exposure. Because even when the most lawless predations of the capitalist state are exposed for all to see, the democratic masses refuse to believe it, and carry on as if state policy and action represents and serves the will of the democratic majority.

What is worse, by the power of omnipresent brainwashing propaganda blasted from the evermore shrill mass media hectorers, the rulers convince the people that the people's interests are identical with the rulers' interests, so the people passionately support the very policies that indebt, impoverish and oppress them.

A people's worldview is easy to bamboozle by presenting a united front of fairy tales to keep them all deceived. It's called controlling the narrative, telling proud and comforting stories that seem to explain the events that are unfolding on the cave wall.

So first, people don't understand the truth about money because they believe we live in a free market democracy.

All of the wise men preach the same neoclassical fairy tales about life in a barter economy where money-issuing banks and capitalist oligarchies don't exist. Indeed "can't" exist, because democratic governments would never surrender their money-issuing power to private bankers; or surrender their political power to plutocrats; and market forces would soon remove the excess profit from the targets of monopoly acquisition.

As long as everybody believes in the ideology and agrees that reality "can't be" the way it is, they see the fairy tale world and not the real world."

FAR BACK IN TIME, SOME SAW IT COMING AND WARNED AGAINST IT, BUT NO ONE HEEDED THEIR WARNINGS.

The Federal Reserve Act was passed in 1913 in response to a wave of bank crises, which had hit on average every six years over a period of 80 years. The resulting economic depressions triggered a populist movement for monetary reform in the 1890s.

Mary Ellen Lease, an early populist leader, said in a fiery speech that could have been written today:

"Wall Street owns the country. It is no longer a government of the people, by the people, and for the people, but a government of Wall Street, by Wall Street, and for Wall Street. The great common people of this country are slaves, and monopoly is the master. . . . Money rules . . . .Our laws are the output of a system which clothes rascals in robes and honesty in rags. The parties lie to us and the political speakers mislead us. . . .

We want money, land and transportation. We want the abolition of the National Banks, and we want the power to make loans direct from the government. We want the foreclosure system wiped out."

That was what they wanted, but the Federal Reserve Act that they got was not what the populists had fought for, or what their leader William Jennings Bryan thought he was approving when he voted for it in 1913. In the speech that won him the Democratic presidential nomination in 1896, Bryan insisted:

"[We] believe that the right to coin money and issue money is a function of government. . . . Those who are opposed to this proposition tell us that the issue of paper money is a function of the bank and that the government ought to go out of the banking business. I stand with Jefferson . . . and tell them, as he did, that the issue of money is a function of the government and that the banks should go out of the governing business."

He concluded with this famous outcry against the restrictive gold standard:

"You shall not press down upon the brow of labor this crown of thorns, you shall not crucify mankind upon a cross of gold."

LITTLE DID OLD WILLIAM KNOW HOW WE'D BECOME A NATION OF MONOPOLY MONEY, NOT WORTH THE INK IT TAKES TO PRINT IT.

WHAT COULD HE HAVE BEEN THINKING?

AFTER A HUNDRED YEARS OF BEING DECEIVED AND CONNED INTO DEBT WE CAN NEVER REPAY, IT'S PAST TIME TO MAKE THE FED A PUBLIC UTILITY.

"The Treasury’s website reports the amount of interest paid on the national debt each year, going back 26 years.

At the end of 2013, the total INTEREST for the previous 26 years came to about $9 trillion on a federal debt of $17.25 trillion.

If the government had been borrowing from its OWN central bank (NOT THE PRIVATE CORPORATION KNOWN AS THE FEDERAL RESERVE) interest-free during that period, the debt would have been reduced by more than half."

And that was just the interest for 26 years.

The federal debt has been accumulating ever since 1835, when Andrew Jackson paid it off and vetoed the Second U.S. Bank’s renewal; and all that time it has been accruing interest.

If the government had been borrowing from its OWN central bank all along, it might have had no federal debt at all today.

In 1977, Congress gave the Fed a dual mandate, not only to maintain the stability of the currency but to promote full employment.

THAT HAS NOT HAPPENED, NOR IS IT LIKELY TO.

It may be time for a new 'populist movement', one that demands that the power to issue money be returned to the government and the people it represents; and that the Federal Reserve be made a public utility, owned by the people and serving them.

The fire-hose of cheap credit lavished on Wall Street needs to be re-directed to Main Street."

Aug 31, 2011

NORTH DAKOTA'S ECONOMIC MIRACLE.

IT ISN'T OIL.

IT'S A STATE-OWNED BANK, THE ONLY ONE IN AMERICA.

"North Dakota is the only state to be in continuous budget surplus since the banking crisis of 2008. Its balance sheet is so strong that it recently reduced individual income taxes and property taxes by a combined $400 million, and is debating further cuts. It also has the lowest foreclosure rate and lowest credit card default rate in the country, and it has had NO bank failures in at least the last decade.

The Bank of North Dakota (BND) does not compete with local banks but partners with them, helping with capital and liquidity requirements. It participates in loans, provides guarantees, and acts as a sort of mini-Fed for the state. In 2010, according to the BND’s annual report:

The Bank provided Secured and Unsecured Federal Fund Lines to 95 financial institutions with combined lines of over $318 million for 2010. Federal Fund sales averaged over $13 million per day, peaking at $36 million in June. The BND’s revenues have also been a major boost to the state budget. It has contributed over $300 million in revenues over the last decade to state coffers, a substantial sum for a state with a population less than one-tenth the size of Los Angeles County. According to a study by the Center for State Innovation, from 2007 to 2009 the BND added nearly as much money to the state’s general fund as oil and gas tax revenues did (oil and gas revenues added $71 million while the Bank of North Dakota returned $60 million). Over a 15-year period, according to other data, the BND has contributed more to the state budget than oil taxes have.

Thanks in part to these institutional arrangements, North Dakota is the only state that has been in continuous budget surplus since before the financial crisis and it has the lowest unemployment rate in the country.

All could learn from the state-owned bank that allows North Dakota to capitalize on its resources to full advantage. States that deposit their revenues and invest their capital in large Wall Street banks are giving this economic opportunity away."

NEW JERSEY AND ABOUT 7 OTHER STATES HAVE SINCE LOOKED INTO CREATING STATE-OWNED BANKS.

THE FED WON'T ALLOW THAT TO TAKE ROOT.

AND IT LOOKS TO ME LIKE THE AMERICAN PEOPLE HAVE DECIDED THEY LIKE BEING DEBT SLAVES ALL THEIR LIVES.

LIKE MY WISE UNCLE ALWAYS SAID, "YOU MUST LIKE IT OR ELSE YOU'D CHANGE IT."

A NATION OF SLAVES...WHO WOULD HAVE EVER IMAGINED IT?

___________________________

FURTHER READING AND SOURCES NOT CITED ABOVE:

~How US Companies Stash Billions Overseas—Tax-Free | Mother Jones

~Fortune 500 Companies Hold a Record $2.4 Trillion Offshore

~WHAT A STATE-OWNED BANK COULD DO FOR NEW JERSEY

~July 08, 2009 , ECONOMIST WARNED OF THE 'BANKING CRISIS' BUT NO ONE LISTENED.

~CAPITALISM AND THE FEDERAL RESERVE

~WHY MOST AMERICANS CAN'T BELIEVE THE TRUTH ABOUT MONEY

~ BLOOMBERG VERSUS THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE

~ FREEDOM OF INFORMATION CASES

~https://youtu.be/2PO3gxqqxKo

A Youtube video shows Identities of financial institutions that may have collapsed without assistance from the government's emergency lending programs.

~Bail-out records released

~Wall Street aristocracy got billions in FED loans and American taxpayers get the bill.

~Federal Reserve banks are private corporations

//WW

No comments:

Post a Comment