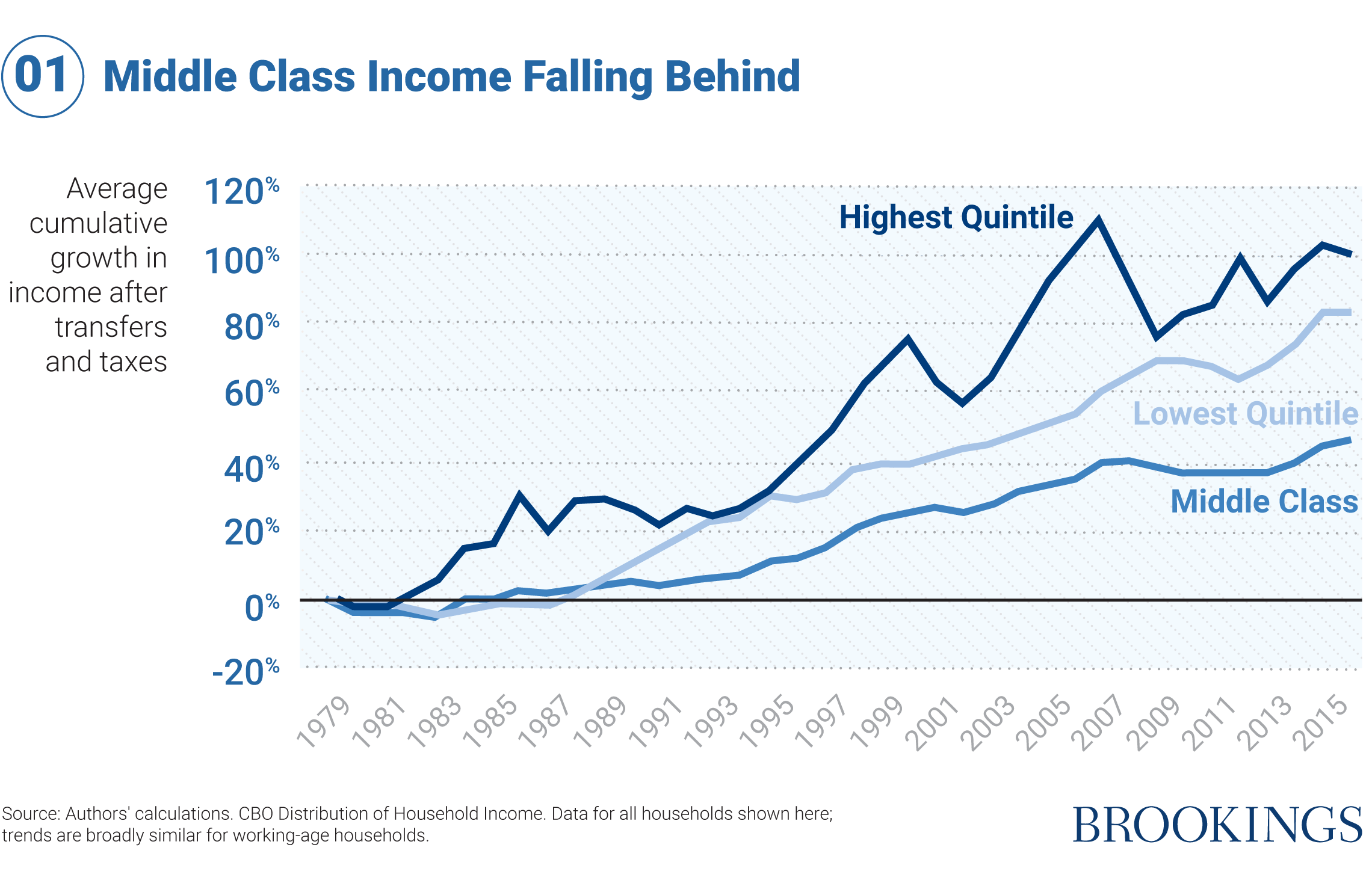

From Brookings Institution, how the middle class shoulders the burden while falling further behind.

The average American can’t scrape together $500 for an emergency. A third of Americans can’t afford food, shelter, and healthcare. Healthcare for a family now costs $28k — about half of median income, which is $60k.

The total net worth of the nation’s 651 billionaires rose from $2.95 trillion on Mar. 18 — the rough start of the pandemic shutdowns — to $4.01 trillion on Dec. 7, a leap of 36%, based on Forbes billionaires, according to a new report by Americans for Tax Fairness (ATF) and the Institute for Policy Studies (IPS).

Combined, just the top 10 billionaires are now worth more than $1 trillion.

By around Mar. 18 most federal and state economic restrictions in response to the virus were in place.

We can immediately see 4 major facts the $1 trillion wealth gain by 651 U.S. billionaires since mid-March has 'produced':

1- It's more than it would cost to send a stimulus check of $3,000 to every one of the roughly 330 million people in America. A family of four would receive over $12,000.

Combined, just the top 10 billionaires are now worth more than $1 trillion.

By around Mar. 18 most federal and state economic restrictions in response to the virus were in place.

We can immediately see 4 major facts the $1 trillion wealth gain by 651 U.S. billionaires since mid-March has 'produced':

1- It's more than it would cost to send a stimulus check of $3,000 to every one of the roughly 330 million people in America. A family of four would receive over $12,000.

YES, Republicans have blocked new stimulus checks from being included in the pandemic relief package.

BUT THEY KNOW HOW FUTILE SUCH A SMALL AMOUNT MEANS WHEN AMERICANS HAVE THIS MUCH DEBT AMIDST 'LOCK-DOWNS/STAY-HOME ORDERS'.

IT'S LIKE PISSING ON A FOREST FIRE.

2- It's double the two-year estimated budget gap of all state and local governments, which is forecast to be at least $500 billion.

By June, state and local governments had already laid off 1.5 million workers and public services — especially education — faced steep budget cuts.

3- It's only slightly less than total federal spending on Medicare ($644 billion in 2019) and Medicaid ($389 billion in FY2019), which together serve 120 million Americans (69 million in Medicaid, 63 million in Medicare, less 12 million enrolled in both).

Nearly four times the $267 billion total in stimulus payments made to 159 million people earlier this year.

4- At $4 trillion the total wealth of all U.S. billionaires today is nearly double the $2.1 trillion in total wealth held by the bottom half of the population of 165 million Americans.

“Never before has America seen such an accumulation of wealth in so few hands,” said Frank Clemente, executive director of Americans for Tax Fairness. “As tens of millions of Americans suffer from the health and economic ravages of this pandemic, a few hundred billionaires add to their massive fortunes. Their pandemic profits are so immense that America’s billionaires could pay for a major COVID relief bill and still not lose a dime of their pre-virus riches. Their wealth growth is so great that they alone could provide a $3,000 stimulus payment to every man, woman and child in the country, and still be richer than they were 9 months ago.

The updraft of wealth to the billionaire class is disturbing at a time when tens of millions face eviction, job loss, destitution, and other loss.

Chuck Collins of the Institute for Policy Studies and co-author of Billionaire Bonanza 2020, a report looking at pandemic profiteering and billionaire wealth said, “Billionaires are extracting wealth at a time when essential workers are pushed into the viral line of fire.”

FROM 'TIME':

No Income. Major Medical Bills. What Life Is Like for Millions of Americans Facing Financial Ruin Because of the Pandemic

FROM 'TIME':

No Income. Major Medical Bills. What Life Is Like for Millions of Americans Facing Financial Ruin Because of the Pandemic

"The growing gap between America’s rich and everyone else is hardly new. But the extra-ordinarily rapid economic collapse catalyzed by COVID-19 has made the chasm deeper and wider, with edges that keep crumbling under the feet of those crowded on the edge.

Since mid-March, more than 30 million people have filed for unemployment—more than three times as many as lost their jobs during the two-year-long Great Recession.

Meanwhile, after a steep but brief dip in March, the stock market rallied. The richest and most well–connected are seeing their wealth re-accumulate, as if by magic, while middle- and working–class families drown in debt that deepens with every passing week.

The contrast isn’t just between low-wage workers and billionaire bosses.

The contrast isn’t just between low-wage workers and billionaire bosses.

Bills are mounting for small restaurants and retailers as their applications for the federal Paycheck Protection Program go unanswered.

But firms like Hallador Energy, an Indiana coal company that hired former Environmental Protection Agency chief Scott Pruitt as a lobbyist, raked in millions from the program.

Small retailers closed to comply with social–distancing orders while e-commerce sales, especially from the biggest online platforms, have spiked. BUT Amazon reported a 26% jump in revenue in the first quarter.

College-educated employees who can work remotely have, so far, largely been spared, still drawing paychecks and watching their savings grow as they cancel vacations and dinners out and complain about how boring it is to stay at home.

One analysis of unemployment–insurance claims in California found that nearly 37% of workers with just a high school diploma have filed for benefits since March 15, compared with less than 6% of those with a bachelor’s degree.

"That may change, of course. No group is safe in a recession of this magnitude."

There’s no reason to believe that the conditions that led us here will change on their own. Already, more companies are talking about replacing workers with machines. And recessions are not good for workers’ leverage. With millions of people now desperate for any income at all, companies can offer less and demand more.

"That may change, of course. No group is safe in a recession of this magnitude."

There’s no reason to believe that the conditions that led us here will change on their own. Already, more companies are talking about replacing workers with machines. And recessions are not good for workers’ leverage. With millions of people now desperate for any income at all, companies can offer less and demand more.

Why America is the World’s First Poor Rich Country

Or, How American Collapse is Made of a New Kind of Poverty

And that is the proverbial elephant in the room we aren’t quite seeing. After all, authoritarianism and extremism don’t arise in prosperous societies, but in troubled ones, which are growing impoverished, like America is today.

NO, Americans are not living on a few dollars a day, by and large, like people in, for example, Somalia or Bangladesh.

America’s median income is still that of a 'rich country', around $50k, depending on how it’s counted.

But middle class incomes have shrunk 8.5 percent since 2000.

Or, How American Collapse is Made of a New Kind of Poverty

And that is the proverbial elephant in the room we aren’t quite seeing. After all, authoritarianism and extremism don’t arise in prosperous societies, but in troubled ones, which are growing impoverished, like America is today.

NO, Americans are not living on a few dollars a day, by and large, like people in, for example, Somalia or Bangladesh.

America’s median income is still that of a 'rich country', around $50k, depending on how it’s counted.

But middle class incomes have shrunk 8.5 percent since 2000.

America appears to be pioneering a new kind of poverty altogether, one for which we don't yet have a name.

It's something like living on the knife’s edge, constantly being on the brink of ruin, one small step away from catastrophe and disaster, ever at the risk of falling through the cracks.

It has two components; massive inflation for the basics of life, coupled with crushing, asymmetrical risk.

Our 'average' American income doesn't go very far.

Most of it is eaten up by attempting to afford the basics of life. We’ve already seen how steep healthcare costs are. But then there's education. There's transport.

There's interest and several kinds of taxes and mortgages or rent.

There's payments for media and communications. There's childcare and elderly care and home upkeep.

We have to eat, we have to be clothed, we have to heat and cool and light our homes.

We have to eat, we have to be clothed, we have to heat and cool and light our homes.

All these things reduce the average American to constantly living right at the edge of ruin — one paycheck away from poverty, from homelessness, one emergency away from losing it all.

All the things that really elevate people’s quality of life — healthcare, finance, education, transport, housing, and so on — have come to consume such a large, constantly rising share of the average household’s income that we have little left to save, invest, or spend on anything else.

And what’s worse, while the basics of life have seen massive inflation, wages and incomes (not to mention savings and benefits and safety nets and opportunities) for most have stagnated. The result is an economy — and a society — that’s collapsing.

That's the straightforward effect of giving, for example, hedge funds control over drugs, or speculators control over housing, healthcare, and education — they will of course maximize profits, whereas investing in these things socially, or at least regulating them, minimizes real costs, and maximizes accessibility, affordability, and quality.

So the average American, who is left high and dry, must borrow, borrow, borrow, just to maintain a decent quality of life...until the debt is too much and average J.Q. Citizen can't borrow another dime.

In 1992, the median level of debt for the middle third of families stood at $32,200.

By 2010, that figure had swelled to $84,000, an increase of 161 percent.

THIS IS WHAT THE MILLIONAIRES IN CONGRESS, THOSE WHO NEVER LIVE PAYCHECK-TO-PAYCHECK, REFUSE TO SEE AND/OR ADMIT.

MOST AMERICANS ARE BUSTING THEIR BUTTS, SCRATCHING AND CLAWING TO SURVIVE, WHILE CONGRESS DEBATES THROWING THE MASSES ANOTHER BONE OF A LOUSY $1200 OR EVEN A SMALLER BONE OF $600.

AT THIS POINT IN THE ECONOMIC COLLAPSE, FOLLOWING THE PERIODS OF HISTORICAL STOCK MARKETS, INCREDIBLY LOW UNEMPLOYMENT RATES, JUST AS AMERICA WAS SEEN TO BE THRIVING AGAIN AFTER THAT "BUBBLE BURST" IN 2007-2008, THE POWERS THAT BE GAVE US COVID MANDATES, RULES TO COMPLETE THE FALL.

FOR THE MOST PART, AMERICANS AGREED TO THE WRECKING BALLS.

ONLY IF AMERICANS DECIDE TO REVERSE THAT AGREEMENT CAN WE AT ALL HAVE ANY WEE HOPE THAT WE WON'T ALL BECOME A NATION OF INDENTURED SERFS.

IT'S EITHER END THIS &@^$#%&! LOCKDOWN BULLSH*T OR FIND OURSELVES WHERE VENEZUELA IS.

//WW

No comments:

Post a Comment